City Of Seattle Business Licenses

Posted By admin On 01.12.20- City Of Seattle Business Licenses Lookup

- City Of Seattle Business Licenses Tax

- City Of Seattle Business License Office

- City Of Seattle Business License Requirements

Apply for a license on-line Many localities let you apply for a business license using the State of Washington Business Licensing Service. Residents of Bellevue, Everett, Seattle, and Tacoma may use the FileLocal website. Licensing requirements can change periodically. The fee for the City of Seattle Business License is calculated as follows for the first location (plus a fee of $10 for each additional branch of the business located within Seattle city limits): Businesses operating prior to July 1 with a worldwide gross income of over $20,000 in the current calendar year submit payment of $90. Dataset contains active business license data for the City of Seattle for 2012 updated in June 2013. All pizza Seattle COMMUNITY. Dataset contains active business license data for the City of Seattle for 2016, as of June 30, 2016. Every business in Seattle is required to have a Seattle business license, and they’ll need to file a business license tax return in addition to filing with the state. You can file for a business license by going to the City of Seattle’s website and submitting your forms online.

Anyone doing business in Seattle must have a Seattle business license tax certificate. In addition to obtaining a business license tax certificate, business owners must renew this certificate each year by Dec. 31. You can apply and renew online at FileLocal, or you can do so via mail or in person.

How do I apply/renew?

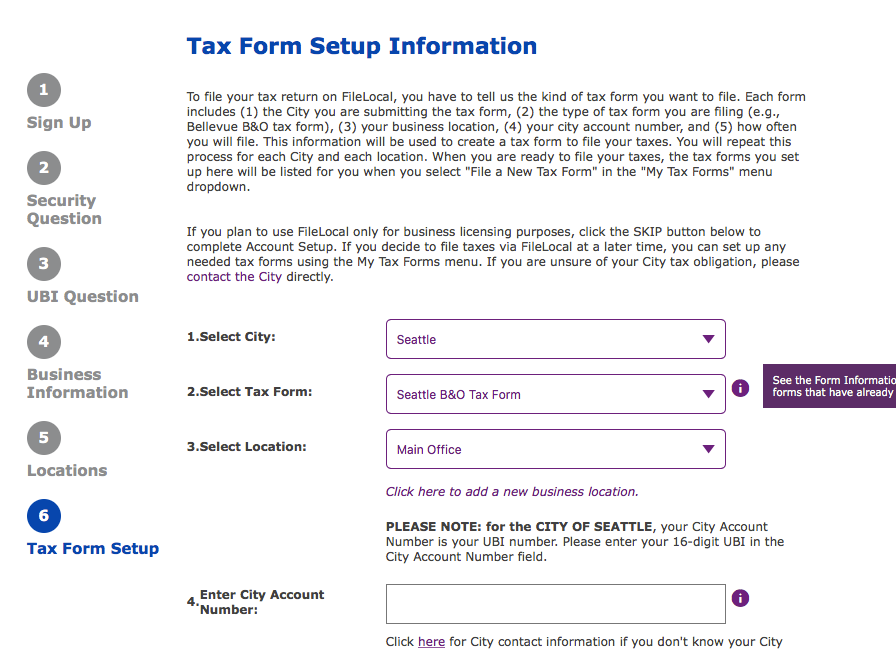

- Online – Apply, renew, manage your account information, file tax returns and pay taxes online through FileLocal. Before you begin the online process, please be sure to obtain a UBI number from the state of Washington if your business is legally required to have one. If you determine that your business is not legally required to have a UBI number, and you are operating as a sole proprietor, you may create a business account on FileLocal by clicking on 'Skip UBI Question,' then selecting 'Enter UBI Later.' This will allow you to proceed with your application. If you are applying for or renewing a license in the current year, you should be able to print it immediately.

- By mail - Download a Seattle business license tax certificate application. Then fill it out and mail it to us along with your payment. You should receive your business license tax certificate in one to six weeks.

- In person – Visit the business licensing office on Floor 42 of the Seattle Municipal Tower, 700 Fifth Ave. You can complete an application, pay the fee and in most cases immediately receive your business license tax certificate.

Lost your license tax certificate?

City Of Seattle Business Licenses Lookup

If you lost or misplaced your business license tax certificate, contact us at 206-684-8484 or tax@seattle.gov. We will mail you another hard copy. Or you can visit us 8 a.m.-5 p.m., Monday-Friday, on the 42nd floor of the Seattle Municipal Tower, 700 Fifth Ave., to get a copy of your business license tax certificate.

Who needs a business license tax certificate?

Most businesses operating in Seattle are required to have a business license tax certificate. Even if you are starting a new business and have not become profitable yet, you must apply for a business license tax certificate and renew it annually. You need a license tax certificate for:

- Retail sales and services

- Wholesale

- Providing professional or personal services

- Manufacturing

- Home-based businesses

- Nonprofit organizations

Please note that only the owner is required to get a business license tax certificate; employees do not need to get individual license tax certificates. If you are unsure whether or not you need a Seattle business license tax certificate, please contact us at tax@seattle.gov or 206-684-8484.

Effective 2019: Any person or business whose annual value of products, gross proceeds of sales or gross income of the business in the city is equal to or less than $2,000 AND does not maintain a place of business within the city shall be exempt from the general business license tax certificate requirement. The exemption does not apply to regulatory license requirements or activities that require a specialized permit.

For details and legal explanations of business license tax certificate requirements, see the Seattle business tax rules.

Regulatory endorsements

The City of Seattle regulates taxis, short-term rentals, adult entertainment, towing companies marijuana businesses and several other business types. These businesses require both a Seattle business license tax certificate and a regulatory endorsement added to the license tax certificate. For more information, see businesses that require a regulatory endorsement.

Licensing information for some specific business types

- Businesses based outside Seattle – If your business is based outside Seattle and you do business within the city, then you must have a Seattle business license tax certificate. In other words, you need a license for where you conduct business; not just for where you're located.

- Subcontractors – Subcontractors need a Seattle business license tax certificate even if the contractor who they are working with already has one. The license is valid only for the legal owner listed on it.

- Nonprofits – If you raise funds in Seattle, whether as a for-profit or non-profit organization, you must have a Seattle business license tax certificate.

- Online-only business – Contact us if you have questions about licensing for online-only businesses. You may need a Seattle business license tax certificate if your business originates from Seattle or has servers within city limits.

- Home-based business – Businesses based in a Seattle home usually need a Seattle business license tax certificate. Contact us if you have questions about licensing for home-based businesses.

- Street/sidewalk vending – In addition to a regular Seattle business license tax certificate, you may need a street-use permit to operate as a street vendor in the City of Seattle. A street-use permit is issued through the Seattle Department of Transportation (SDOT). For more information, see SDOT's Vending Permits page.

How much will my license cost?

All business license tax certificates expire on Dec. 31 and must be renewed annually.

The City of Seattle's Ordinance 125083, established that on Jan. 1, 2020 and on Jan. 1 of every year thereafter, the fees for a business license tax certificate shall be increased consistent with the rate of growth of the prior year's June-to-June consumer price index for the region, as published by the US Department of Labor. The fees are as follows:

Annual Seattle Taxable Revenue | Annual Fee | |||

| 2017 | 2018 | 2019 | 2020 | |

| $0 - $19,999** | $55 | $55 | $55 | $56 |

| $20,000 - $499,999 | $110 | $110 | $110 | $113 |

| $500,000 - $1,999,999 | $480 | $480 | $500 | $511 |

| $2,000,000 or more | $1,000 | |||

| $2,000,000 - $4,999,999 | $1,000 | $1,200 | $1,227 | |

| $5,000,000 or more | $2,000 | $2,400 | $2,455 | |

| Branch locations | $10 per location | $10 per location | $10 per location | $10 per location |

*If you start your business in the second half of the year, July 1 or after, your license tax certificate fee for the first year will be reduced by half.

**Effective 2019: Any person or business whose annual value of products, gross proceeds of sales or gross income of the business in the city is equal to or less than $2,000 AND does not maintain a place of business within the city shall be exempt from the general business license tax certificate requirement. The exemption does not apply to regulatory license requirements or activities that require a specialized permit.

Penalties

The expiration date for all Seattle business license tax certificates is Dec. 31. We must receive your business license tax certificate renewal payment before Dec. 31. This table shows late-payment penalties:

Payment received | Penalty |

| By Dec. 31 | None |

| In January | None |

| In February | $10 |

| After February | $20 |

If you no longer do business in Seattle and need to cancel your business license tax certificate, please tell us in writing. Just letting your business license tax certificate expire does not cancel your license tax certificate.

To cancel your license tax certificate, complete the online form below. Or send us an email or letter with the following information:

- your name and phone number

- customer number

- legal name of the business

- date business closed

City Of Seattle Business Licenses Tax

You must file your final tax return and pay any outstanding taxes within 10 days of closing your account.

Need to look up a business?

City Of Seattle Business License Office

Search the database for licensed Seattle businesses. You can search by business name, industry type or zip code.

The Seattle business license tax certificate database shows you the following information about a business:

S201AA3626EBEDDA67F5592C2Infinite Item #1C9A0DDE2DA89Infinite Item #28A3BDE029A8BInfinite Item #3CA28DE029A89Infinite Item #4883BDD42DA8BInfinite Item #5C828DD42DA89Skills Maxed:Strength/MagicEA688618A591SkillE2480218A590SpeedAA7B8618A593Luck305B215CE7D6DefenceA25B0218A592Magic Defence79E0A5FCE5D111th Position:Infinite HP144EC3FFA02FMaximum HP1C6E47FFA02EInfinite Turns7C3D17FD9020Quick Level Gain1E6E5CA7FF3ASteps +8E5Weapon Lv. Fire emblem gba hacks.

- legal name

- trade name ('doing business as')

- main location address

- phone number

- license tax certificate expiration date

- industry type and North American Industry Classification System (NAICS)